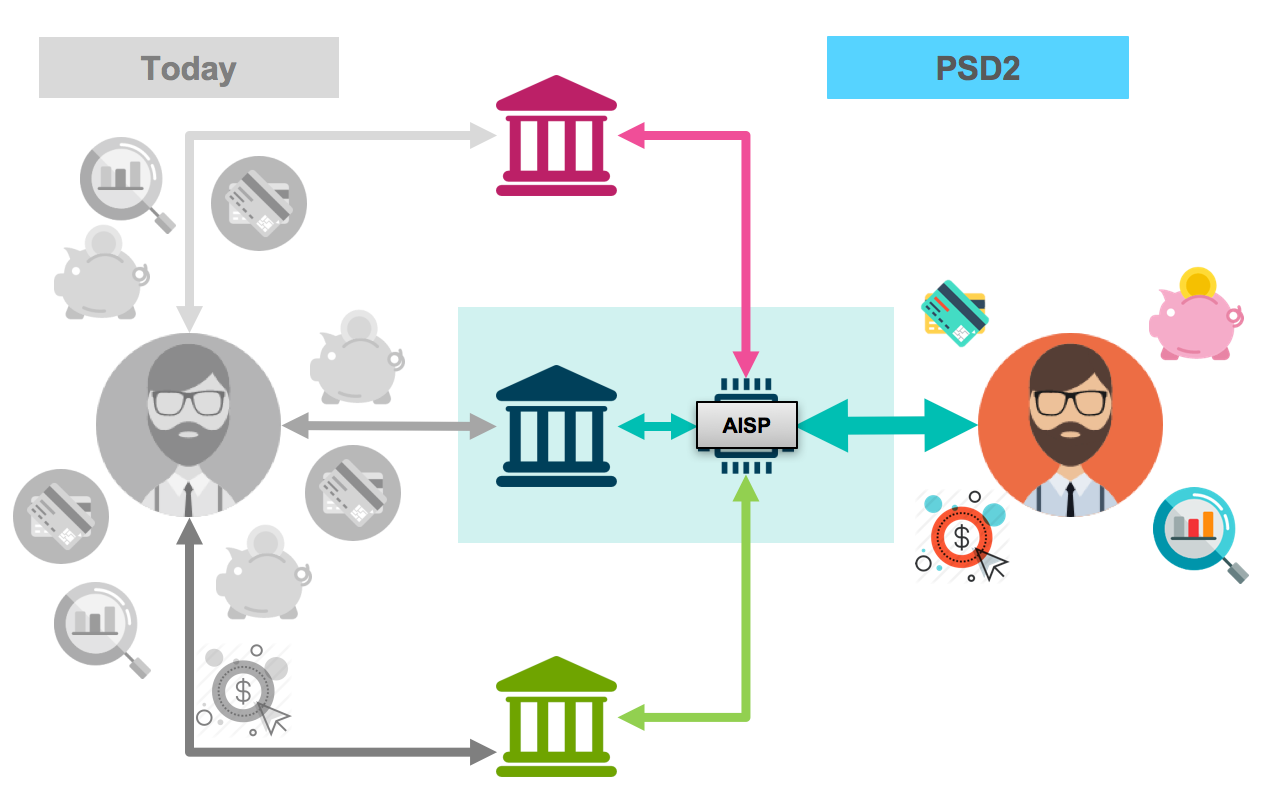

What is new is that account information services and payment initiation services have been added to PSD2. This is a substantial amount of business that is being supervised.

The regulator says: if two entities doing business - a customer and a retailer - use someone who is between them and collects the money and then forwards it, this is a money remittance transaction, and the guy in the middle needs to be monitored. Here, the money remittance transaction is regulated. The most important consideration is: How does money get from Point A to Point B? Usually through an intermediary or a marketplace. From a business perspective, what are the business models that fall under large payment services? One layer deeper: PSD2 regulates payments systems. The changes are not so much regulatory in nature, rather they have to do with consumer rights and consumer protection. There was a relatively high number of participants in the market who were not banks, yet processed significant volumes of payments - a situation prompting regulators to consider setting up a few rules to make sure everything runs smoothly. Regulators apparently saw the need - with good reason - to create certain rules of the game and set a regulatory framework to make sure that payment transactions work, and to keep them running smoothly. Merchants were processing large volumes in the market that had reached a critical mass. There was a clear need in the market to regulate this growing sector.

How did we end up with a PSD2 coming into force in January 2018? To start off with PSD2: obviously there was a PSD1. Jörg Howein (CPO, solarisBank) sat down with Frank Müller (Partner at Aderhold Law, Co-founder of PayTechLaw) for a fireside chat to discuss the implications of the PSD2 for Marketplaces. As a result, online platforms and marketplaces will face a tighter regulatory framework as well as more consistent enforcement across the EU. The European Union’s Payment Service Directive 2, or PSD2, comes into force in January 2018 and will introduce new measures as well as clarify existing ones.

0 kommentar(er)

0 kommentar(er)